How to Apply for Buyback in Angel One?

Applying for a buyback in Angel One is a straightforward process for investors to participate in buyback offers, allowing shareholders to sell their shares at a higher price than the current market price. Below are the steps to apply for a buy back.

Here are Steps to Apply Buyback in Angel One

| Steps | Description |

| 1 | Create an Account with Angel One |

| 2 | Fund Your Account |

| 3 | Check Eligibility and Record Date |

| 4 | Navigate to the Buyback Section |

| 5 | Review the Offer Details |

| 6 | Fill Out the Tender Form |

| 7 | Submit the Tender Form |

| 8 | Wait for Confirmation |

| 9 | Track the Buyback Process |

| 10 | Receive Funds in Your Account |

How Do You Apply Buyback in Angel One?

Step 1: Create an Account with Angel One:

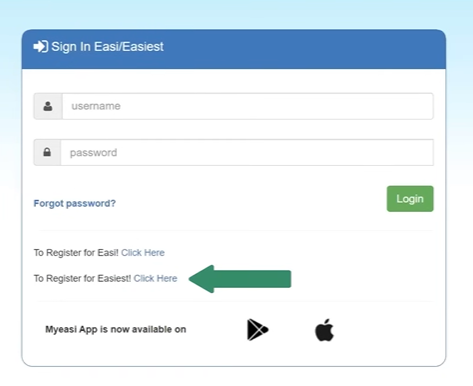

If you don’t already have an account with Angel One, the first step is to create one. Visit the Angel One website or download their mobile app to get started. Follow the registration process, providing the required personal and financial information.

Step 2: Fund Your Account:

To participate in a buyback, ensure that your Angel One trading account has sufficient funds available. You can transfer funds from your bank account to your Angel One account using various payment methods supported by the platform.

Step 3: Check Eligibility and Record Date:

Once logged in to your Angel One account, find information about the buyback you’re interested in participating in. Make sure you check the eligibility criteria and the record date. The record date is crucial as you must hold the company’s shares on or before this date to be eligible for the buyback.

Step 4: Navigate to the Buyback Section:

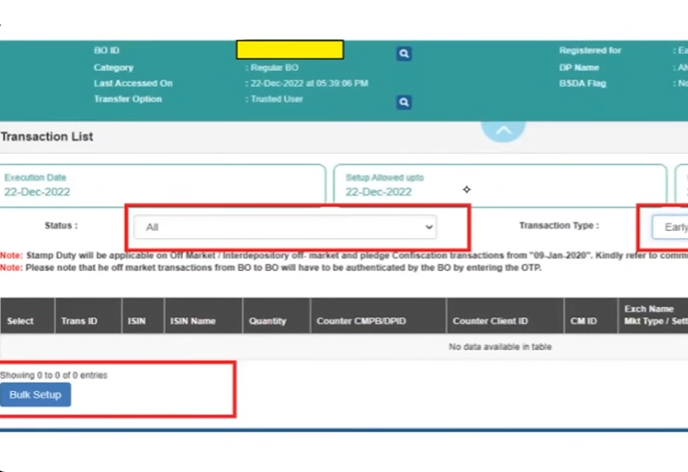

Once you’ve confirmed your eligibility, navigate to the buyback section on the Angel One platform. This section will display all the ongoing buyback offers that you are eligible for.

Step 5: Review the Offer Details:

Click on the specific buyback offer you wish to participate in. Review all the offer details, including the buyback price, the number of shares you hold eligible for buyback, and the acceptance ratio.

Step 6: Fill Out the Tender Form:

Angel One will provide you with a tender form for the buyback offer. In this form, you enter the number of shares you want to tender for the buyback. Make sure you follow the guidelines and provide accurate information.

Step 7: Submit the Tender Form:

Once you have filled out the tender form with the desired number of shares to be tendered, submit it on the Angel One platform. Ensure that the submission is made before the specified deadline for the buyback offer.

Step 8: Wait for Confirmation:

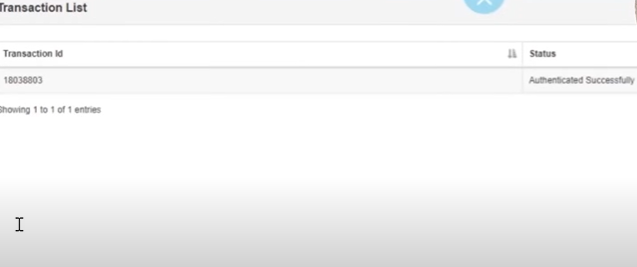

After successfully submitting the tender form, you’ll receive a confirmation of your application. This confirmation will acknowledge the number of shares you’ve tendered for buyback.

Step 9: Track the Buyback Process:

Monitor the offer’s progress during the buyback period. Angel One will update you on the status of your tendered shares and the acceptance ratio as the buyback process unfolds.

Step 10: Receive Funds in Your Account:

If your tendered shares are accepted as part of the buyback, the funds will be credited to your Angel One account once the buyback process is completed. You can then use these funds as per your requirements.

Types of Share Buyback

The different ways to buyback shares in India are listed below.

- Tender Offer

In this method, the company buys back its shares from the shareholders proportionately within a predetermined time.

- Open Market

The company purchases back its shares from the market directly through an open market offer. This procedure is carried out through the company’s brokers. It entails the buyback of a significant number of shares.

- Tender offer with fixed price

In this buyback strategy, the company issues a tender with a fixed price for purchasing the shares. It is usually higher than the existing market price. The tender offer is valid for a limited time. It is generally open for a few days only.

- Dutch Auction Tender offer

Here, the company offers a range of prices for shareholders to choose from. The stock’s minimum price exceeds the existing market value.

Conclusion

Overall, applying for a buyback with Angel One is a straightforward process that involves checking your eligibility, filling out the tender form accurately, and keeping track of the buyback progress. Following these steps properly, you can confidently participate in buyback offers and maximise this opportunity as an investor.