How to Place a Stop Loss Order in Angel One?

On Angel One’s mobile app, you can place a stop-loss order by following these steps:

Step 1: Choose the stock and click ‘BUY’ or ‘SELL.’

Step 2: Go to ‘Smart Orders’ and click ‘Stop Loss Order.’

Step 3: Fill in the ‘Quantity’ and ‘Trigger price.’

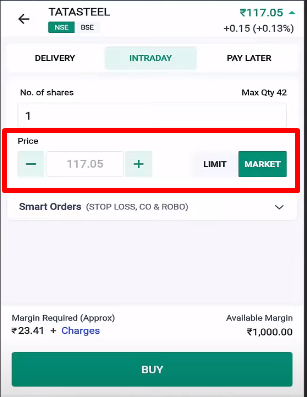

Step 4: Put a stop-loss limit order or a stop-loss market order by selecting Limit or Market

Step 5: Put the ‘Trigger Price’ in.

Step 6: Put in the ‘Limit Price’ if you’re placing a stop-loss order.

Step 7: Your stop-loss order will be placed when you click ‘BUY’ or ‘SELL’.

Stop-loss orders are an integral part of the trading and risk management mechanism. Using them can protect you from much higher losses in the market when it faces a much higher level of losses.

With a stop-loss order, you can limit your losses by placing an order when a certain price is reached. An automatic stop-loss order is executed as soon as the security price reaches the trigger price.

When markets are volatile, stop-losses can be your saving grace. As soon as the stop-loss level is reached, traders are able to automatically close their positions. As a result of squaring off, losses are limited to the next available price at the trigger price level.

How Does a Stop-loss Order Work?

Assume you have a buy position in stock ‘X’ at Rs. 100 and want to place a sell stop-loss order at Rs. 95. To close your position, you must sell the asset, so this is a sell stop-loss order.

A sell-stop-loss market order works like this:

Rs. 95 will be the trigger price. As soon as the Last Traded Price (LTP) reaches Rs. 95, a sell market order will be activated and executed.

For a sell stop-loss limit order:

Rs. 95 will be the trigger price. We’ll keep the Limit Price at Rs. 94. For a sell stop-loss limit order, the trigger price must be greater than or equal to the limit price.

As soon as the LTP hits Rs. 95, a sell limit order is activated, and your order will be executed at the next available bid above the limit price. Your stop-loss order may be executed at a price greater than or equal to Rs. 94 in this case.

Note: In the above example, your stop-loss order will not be executed if the current market price falls below Rs. 94 and does not cross Rs. 94 at any time during market hours.

Consider a scenario where you hold a sell position for stock ‘X’ at Rs. 100 and intend to set a stop-loss order at Rs. 105. Since you are buying the asset to square off your position, this is a buy stop-loss order.

For a buy-stop-loss market order:

The trigger price is set at Rs. 105. When the market price hits Rs. 105, it activates a buy market order, which executes your order at the current market rate.

For a buy stop-loss limit order:

Assuming you set the trigger price at Rs. 105 and the limit price at Rs. 106 (wherein the trigger price must be less than or equal to the limit price for a buy stop-loss limit order).

Consequently, when the market price reaches Rs. 105, the buy limit order is triggered, and your order is processed at the next available ask/offer below Rs. 106. In this scenario, your stop-loss order might be executed at a price equal to or below Rs. 106.

Note: Your position will remain open if the current market price does not fall below Rs. 106 during market hours.