What are the Documents Required for Opening an Account with Angel One?

Opening a Demat account is essential for investors looking to trade and hold securities electronically. Angel One, a renowned financial institution, offers a seamless online account opening process. To ensure a smooth and efficient registration, prospective investors must provide certain mandatory documents to meet regulatory compliance and secure their investment journey. Here is the detailed list of documents that are required to open an account.

Proof of Identity (POI):

- PAN Card: A mandatory requirement for all applicants, the PAN card must include a valid photograph.

- Unique Identification Number (UID): Accepted IDs include Aadhaar, Passport, Voter ID card, and driving license.

- Identity Card/Document: Issued by central or state government departments, statutory/regulatory authorities, public sector undertakings, scheduled commercial banks, professional bodies (ICAI, ICWAI, ICSI, Bar Council), and credit/debit cards issued by banks.

Proof of Address (POA):

- Passport/Voters Identity Card/Ration Card/Registered Lease or Sale Agreement of Residence/Driving License/Flat Maintenance bill/Insurance Copy.

- Utility Bills: Telephone Bill (landline only), Electricity bill, or Gas bill – not more than 3 months old.

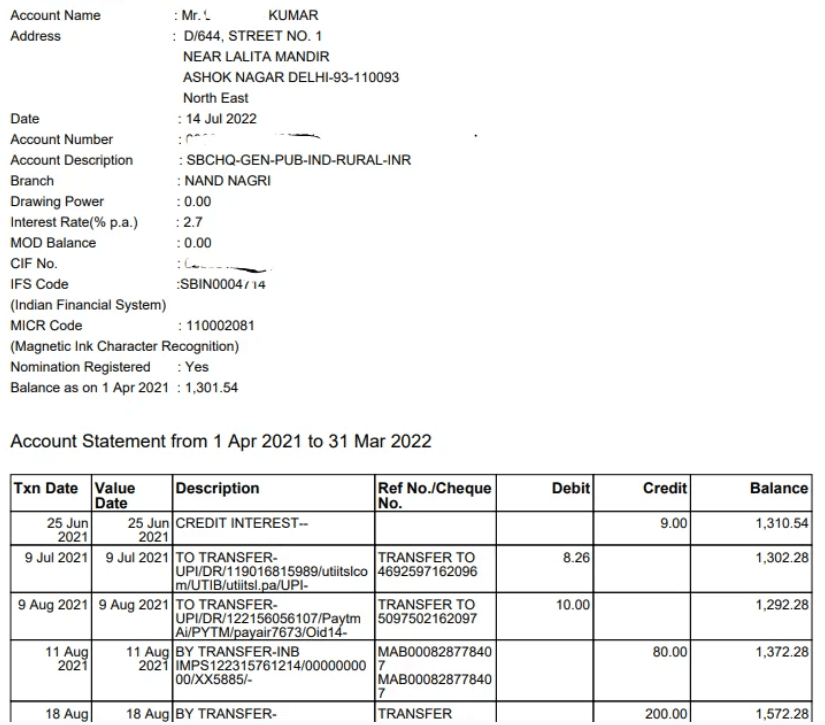

- Bank Account Statement/Passbook: Not more than 3 months old.

- High Court and Supreme Court judges’ self-declaration gives the new address regarding their own accounts.

- Proof of Address issued by authorized entities such as bank managers, gazetted officers, notary public, elected representatives, government, and statutory authorities.

- Identity Card/Document with address issued by recognized entities like government departments, regulatory authorities, public sector undertakings, colleges affiliated to universities, and professional bodies.

- For FII/sub-account: Power of Attorney document given by FII/sub-account to the custodians with registered address.

Proof of Income:

- Photocopy of Income Tax Return (ITR) Acknowledgement slip submitted to the Income Tax Department during tax filing.

- Net Worth Certificate or audited Annual Accounts certified by a Chartered Accountant.

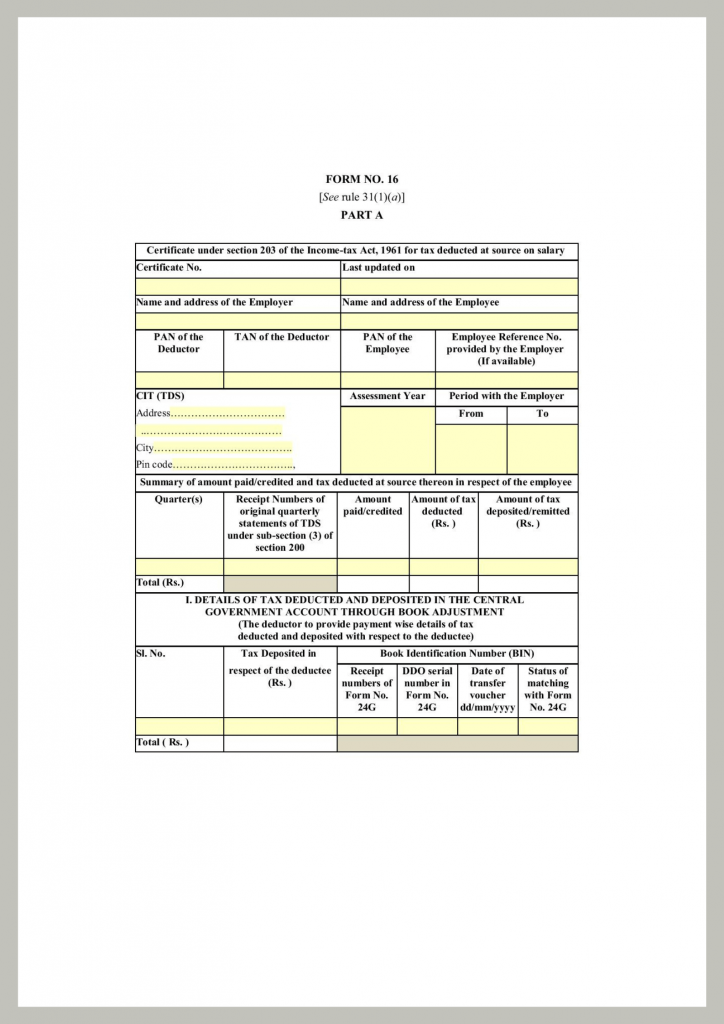

- Proof of Salary: Recent Salary Slip or Form 16.

- Statement of Demat account holdings with an eligible Depository Participant.

- Current bank account statement reflecting the income history of the client for the past 6 months.

- Other self-declared documents substantiating ownership of assets and income.

Exemptions/Clarifications to PAN:

- Transactions on behalf of the central and state government.

- Investors residing in Sikkim.

- UN entities.

- SIP (Systematic Investment Plan) investments of up to Rs. 50,000 per year.

Authorized Attestation:

- Documents must be attested by one of the following:

- Notary Public.

- Gazetted Officer.

- Manager of a Scheduled Commercial/Co-operative Bank.

- Manager of Multinational Foreign Banks.