How Do I Apply for the Right Issue at Sharekhan?

Applying for a rights issue through Sharekhan includes several methods to ensure a simple process. Here’s how to step-by-step guide to apply for a rights issue at Sharekhan

Steps to Apply for Right Issue at Share Khan

| Steps | Description |

| 1 | Login and go to the ASBA Services Area |

| 2 | Select the IPO/FPO/BUYBACK Option |

| 3 | Enter the Number of Shares |

| 4 | Check the Applicable Box |

| 5 | Ensure that you have Enough Money in your Account |

| 6 | Complete the Transaction and Review your Order |

Apply for the Right Issue through ASBA/Net Banking

Below are the steps to apply for a rights issue through ASBA/Net Banking:

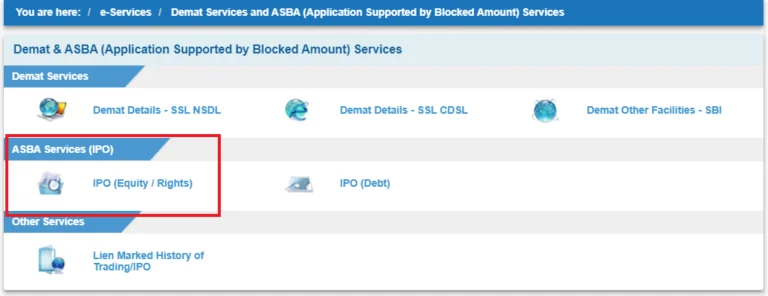

Step 1: Log into your brokerage account online and go to the ASBA services area.

Step 2: Select the IPO/FPO/BUYBACK option to see all available rights offerings.

Step 3: Enter the number of shares you want to buy and submit your application.

Step 4: Check the applicable box to indicate that you agree to the terms and conditions.

Step 5: Ensure that you have enough money in your account to execute the transaction.

Step 6: Complete the transaction and review your order in the order book.

In addition, you may submit your application for the rights issue through the Registrar and Transfer Agent’s website.

Applying for the Right Issue in RTA

RTAs in India include CAMS and KFin Technologies Limited. Below is the example of KFin Technologies Limited to demonstrate the method.

Step 1: Go to the KFin Technologies Limited RTA website (https://rights.kfintech.com/). You will only have the opportunity to apply if the rights issue is open.

In this case, the “Apply for Rights Issue” option will be activated upon opening. But first, click on “email and mobile registration”.

Step 2: Determine if you have actual shares or the depository with which you have an account.

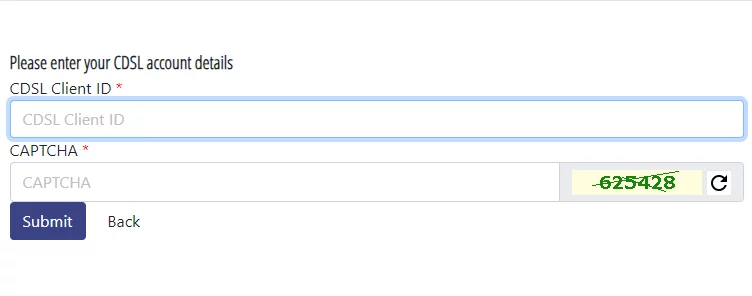

Step 3: Enter basic information such as DP ID, customer ID, and Captcha and click Submit.

Step 4: On the following screen, enter your email address and cellphone number.

Registering your mobile number and email address will make sure that you receive all the allocation information.

If you already have a Demat account but still own RIL shares in physical form, Follow the below steps to register your Demat Account Number Information for the rights issue.

Step 1: Navigate to the next tab, “Demat Account Number Information Registration.”

Step 2: Follow the instructions that appear on the screen.

Step 3: When you are ready to proceed, click “Proceed”.

Step 4: Enter your PAN number, Demat account number, and other needed information when requested.

Step 5: Once you have completed the registration procedure, you will be ready to register for the rights issue when it becomes available on May 20. You may pay for your order using either UPI or NEFT.

Things to remember:

- The UPI payment maximum is Rs 2 lakh.

- For each order you place, a charge of Rs 314.25 per share will be deducted from your bank account instantly.

- If you receive fewer shares than you requested, the surplus payment will be reimbursed to your bank account.

Important Note:

When you put a successful order for the rights, the order amount is locked in your bank account. The amount blocked in your bank account cannot be used for anything else, thus you are unable to withdraw. The money is safe in your account.

If you fail to receive a share, the funds you requested for the rights issue will be unlocked and available for withdrawal. So, plan properly for your financial needs.