How Do I Apply for Buyback in Sharekhan?

List of Steps to Apply for Buyback in Sharekhan

| Steps | Description |

| 1 | Log into Your Account |

| 2 | Check Eligibility |

| 3 | Select the Buyback Offer |

| 4 | Submit Your Bid |

| 5 | Review and Confirm |

| 6 | Wait for Results |

| 7 | Settlement |

How to Apply for Buyback Online in Sharekhan ?

If you are a Sharekhan account holder and wish to participate in a buyback, you can follow these steps:

Step 1: Log into Your Account: Visit the Sharekhan website and log in to your trading account using your credentials.

Step 2: Check Eligibility: Ensure that you are eligible to participate in the Buyback. This may depend on factors such as your holding period and the number of shares you own.

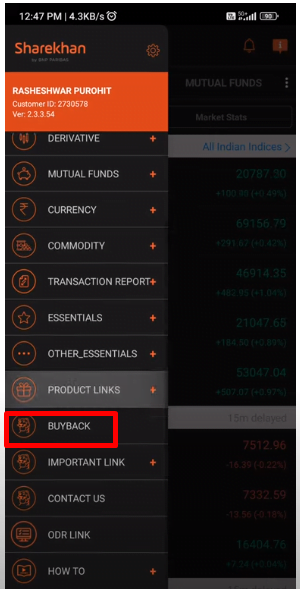

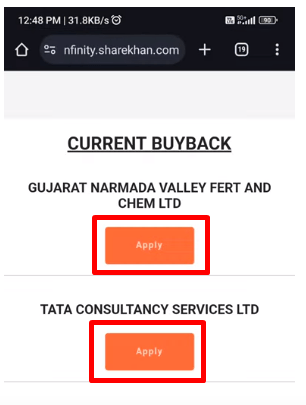

Step 3: Select the Buyback Offer: Navigate to the ‘Corporate Actions’ or ‘IPO/Buyback’ section of your Sharekhan account to find information about ongoing buyback offers.

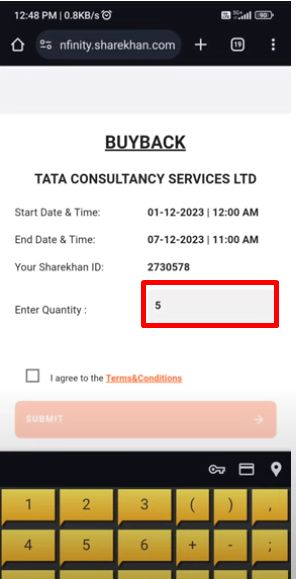

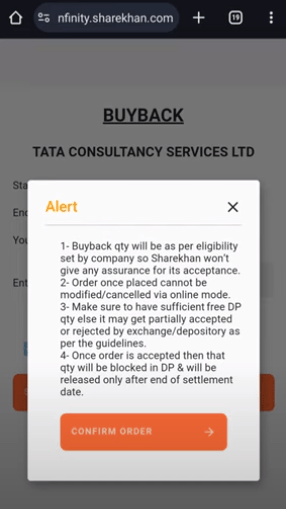

Step 4: Submit Your Bid: Choose the specific buyback offer you want to participate in and submit your bid. You may need to specify the number of shares you wish to tender and the price at which you are willing to sell them.

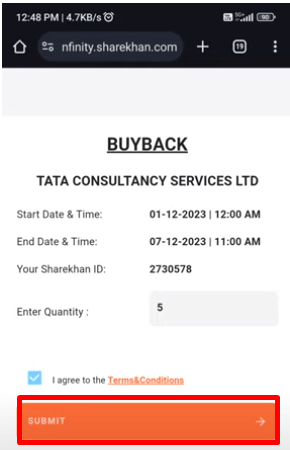

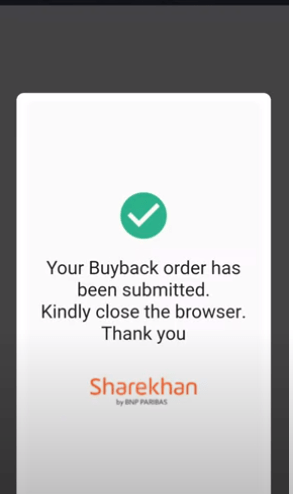

Step 5: Review and Confirm: Double-check your bid details and confirm your submission.

Step 6: Wait for Results: After the buyback offer period ends, the Company will announce the results. If your bid is accepted, the Company will repurchase your shares at the specified price.

Step 7: Settlement: Once the Buyback is complete, you will receive the payment for the shares you sold during the Buyback.

Methods of Buyback

The following methods are often included in a buyback process:

- Board Approval: The buyback plan, which includes the number of shares to be repurchased and the price range, is approved by the company’s board of directors.

- Shareholder Approval: If the proposed Buyback involves a sizable sum of money, shareholders may be required to vote on it.

- Tender Offer: The corporation publishes a tender offer that details the conditions of the Buyback, such as the amount to be repurchased and the time frame for the offer.

- Investor Choice: Investors choose whether to take part in the repurchase. They have the option of tendering their shares at the predetermined price or keeping their shares.

- Execution of the Buyback: After the Tender Period expires, the Company repurchases the Shares from the Participants in the Buyback.

- Cancellation of stock: Repurchased shares can be canceled or held as treasury stock for future usage, which will lower the number of outstanding shares.

Conclusion

As repurchase offers might differ from one company to another, it’s critical to keep up with the most recent information. Additionally, for more specific advice on taking part in buybacks that fit your investing strategy, speak with your broker or financial advisor.