How Can I Track the Dividend of My Stock Holding at Kotak Securities?

Kotak Securities facilitates the download of Holding Statements, vital in comprehending investment transactions. These documents provide a comprehensive view of an individual’s or entity’s investment portfolio, encompassing details about Mutual Funds or Pension Funds. The holdings include an array of investment products such as stocks, bonds, mutual funds, F&O, and exchange-traded funds (ETFs).

These statements can be conveniently downloaded through the brokerage platform, similar to accessing Contract Notes and Tax P&L Statements from Kotak Securities. These documents serve a crucial purpose in calculating Income Tax on Trading activities.

For Kotak Securities traders seeking to download Holding Statements, follow these simple steps:

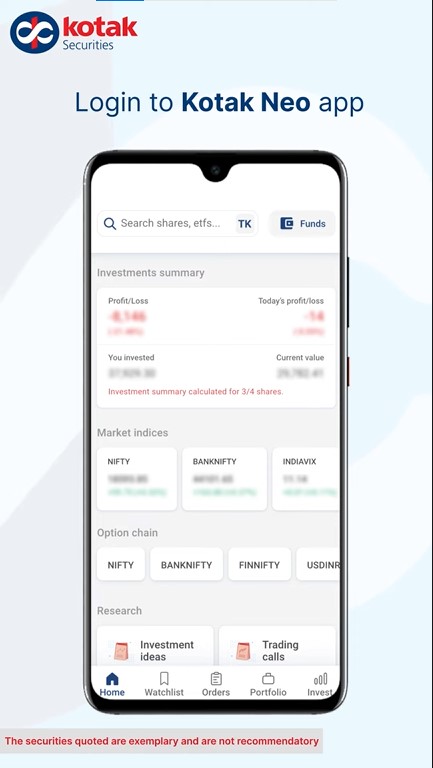

Step 1: Visit the Kotak Securities portal and log in with the required credentials.

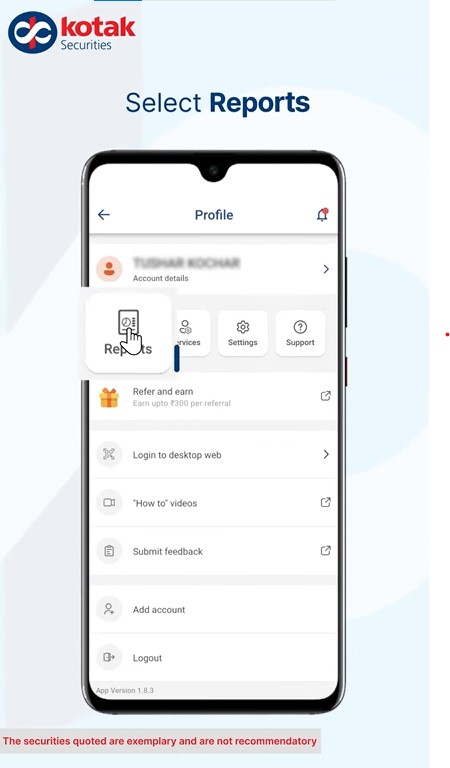

Step 2: Access the dashboard and click on the ‘Reports’ section.

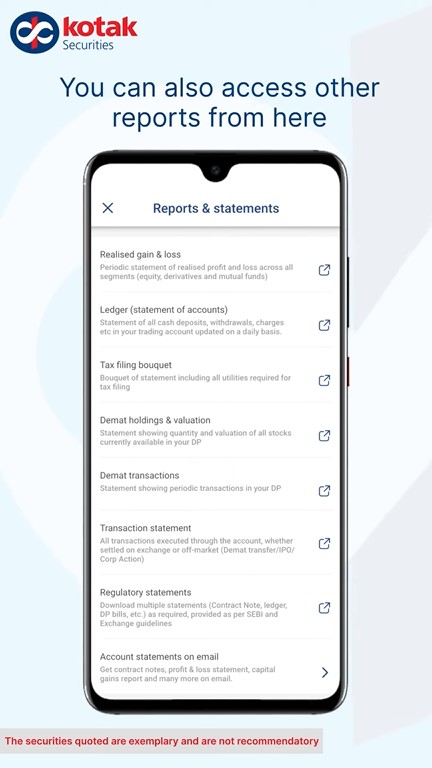

Step 3: Select the ‘DP Holdings’ option from the dashboard menu.

Step 4: Look for the download option, usually located at the bottom of the page.

Step 5: Click on the download option to retrieve your Holding Statements effectively.

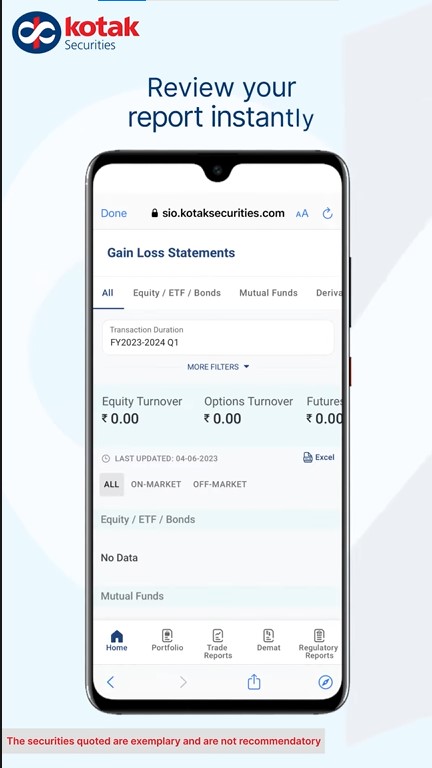

These steps offer a seamless way for traders to obtain their Holding Statements, aiding in better understanding their investment portfolio and facilitating tax compliance for trading activities.

Conclusion

Tracking dividends for your stock holdings at Kotak Securities is a straightforward process once you have set up online access to your account. By regularly monitoring your portfolio and staying informed about dividend announcement and record dates, you can ensure that you receive the dividends you’re entitled to. Additionally, consider exploring options like dividend reinvestment and leverage the research tools provided by Kotak Securities for a more comprehensive investment strategy. Remember to keep accurate records for tax purposes, as dividends are a taxable source of income. With these steps in place, you’ll be well-equipped to manage your stock holdings effectively.