How to Generate TPIN in Kotak Securities?

Safeguarding your investments is of paramount importance. One crucial aspect of securing your securities investments is through a Demat account, which allows you to hold and trade securities electronically. To add an extra layer of protection, many Demat account providers have introduced a feature known as TPIN (Transaction Personal Identification Number). In this article, we will delve into what a Demat account TPIN is, its functionality, and why it is crucial for investors.

Steps to Generate TPIN in Kotak Securities

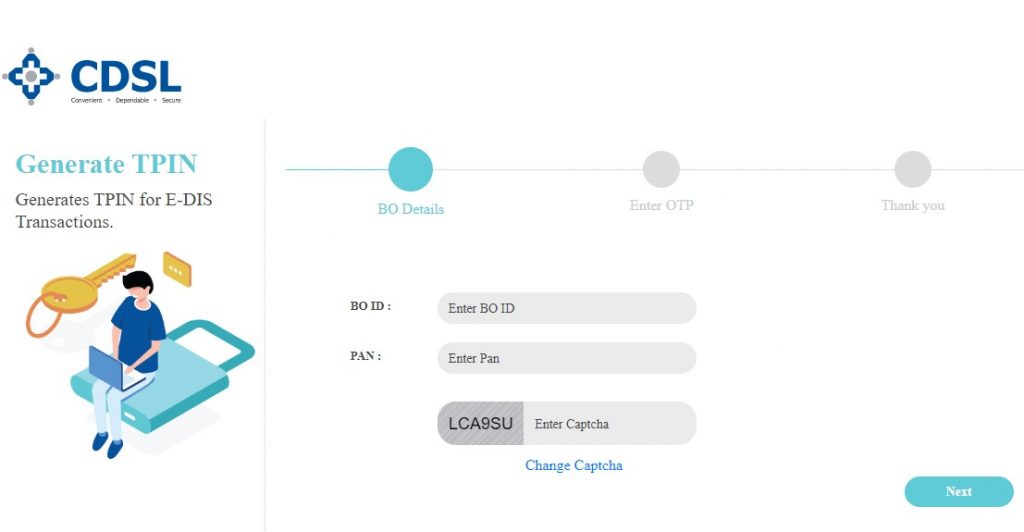

Step 1: Visit CDSL Website

Go to the CDSL website, where you can generate your TPIN.

Step 2: Locate ‘Generate e-DIS TPIN’

Look for the link labeled ‘Generate e-DIS TPIN’ and click on it.

Step 3: Enter BO ID and PAN Details

Provide your BO ID (Beneficial Owner Identification Number), a 16-digit Demat account number, and your PAN details. Click on ‘Next’.

Step 4: OTP Verification

An OTP will be sent to your registered mobile number and email ID. Enter the OTP in the designated field.

Step 5: Receive TPIN

After completing the steps, you will receive your generated TPIN via both your mobile number and email.

What is the TPIN Number?

Introduced in June 2020, TPIN is a 6-digit password that authorizes the broker to deduct specific stocks from your Demat account. It serves as an alternative to the Demat power of attorney, allowing you to independently authorize the online sale of shares from your Demat account. The TPIN remains valid for a single day and is limited to the specific stocks for which it has been provided. This feature ensures that shares can only be moved out of your Demat account with your explicit approval, providing you with safety, security, and complete control.

How did TPIN Come into the Picture?

Previously, broking houses required your authorization for transactions to proceed, typically through a Power of Attorney (POA) document. This document granted them permission to withdraw securities from your account when you sold them. Unfortunately, this led to instances of misuse, with some broking houses engaging in unauthorized trades. The Securities and Exchange Board of India (SEBI) recognized this issue and introduced the TPIN concept to rectify it.

How Does TPIN Work?

The TPIN system is used in transactions like buying or selling securities, ensuring only authorized account holders can proceed. It provides security, accountability, and traceability by creating a digital trail for audits and monitoring, enhancing transparency and identifying potential security breaches.

Changing TPIN

Visit CDSL Website: Go to the CDSL website.

Provide BO ID and PAN Number: Enter your BO ID and PAN number in the appropriate fields, then click on “Next.”

OTP Verification: You will receive an OTP from CDSL, sent to both your registered email ID and mobile number. Enter the received OTP.

Set New TPIN: Once you successfully verify the OTP, you will be prompted to enter a new TPIN. Please note that the newly generated TPIN will require approximately 5 to 10 minutes to get activated before it can be utilized.

Importance of Demat Account TPIN

Enhanced Security: TPIN provides an extra layer of security, safeguarding your investments from potential fraud or misuse.

Reduced Risk of Unauthorized Access: The requirement of TPIN minimizes the chances of unauthorized access to your Demat account.

Control Over Transactions: TPIN empowers investors with better control over their Demat account transactions, aiding in detecting and preventing any fraudulent activities promptly.

Compliance with Regulatory Guidelines: The implementation of TPIN is in line with regulatory guidelines, ensuring the protection of investors’ interests.

Convenience with Security: TPIN strikes a balance between security and convenience, allowing you to access and manage your investments while keeping them safe conveniently.

Overall, TPIN is a vital tool in securing your investments through a Demat account. It offers enhanced security, reduces the risk of unauthorized access, and provides you with control over your transactions. By following the simple steps provided, you can easily generate and manage your TPIN, ensuring the safety of your investments in Kotak Securities.