How to Place Stop Loss Order in ICICI Direct?

A stop-loss order refers to the buy or sell order which is used to prevent losses when there is a risk that market prices are going against the expected price.

Steps to Place Stop Loss Order in ICICI Direct

| Steps | Descriptions |

| 1 | Login to Trading Account |

| 2 | Enter Portfolio Section |

| 3 | Select Stock to Apply Stop Loss |

| 4 | Check for Equity Portfolio Holdings |

| 5 | Ensure Stop-Loss Profitability |

| 6 | Enter Quantity of Stocks to Provide Stop Loss |

| 7 | Set Stop Loss Price |

| 8 | Verify Accuracy |

| 9 | Send Stop Loss Order for Execution |

| 10 | Track Performance of Holdings |

How do I Place a Stop Loss Order in ICICI Direct

Below are the steps on how to place stop loss orders in ICICI Direct in simple and practical steps.

Step 1: Start by logging in to the mobile app which is linked to your trading account.

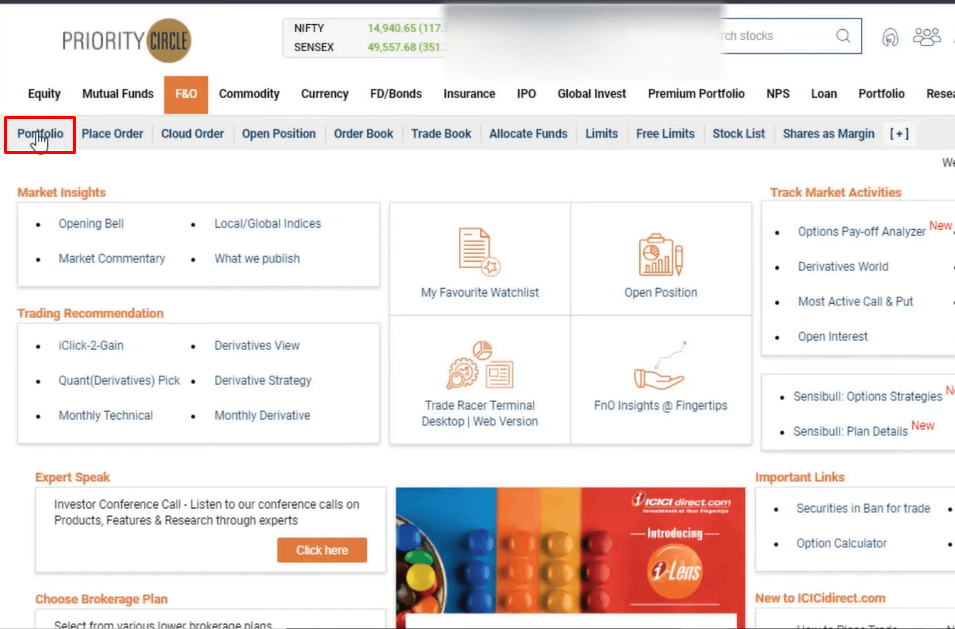

Step 2: Once logged in, the app screen would show your account overview, In that, enter into the portfolio section.

Step 3: In the portfolio section, identify the stocks that are dominant in your balance and that you are wishing to apply for a stop-loss.

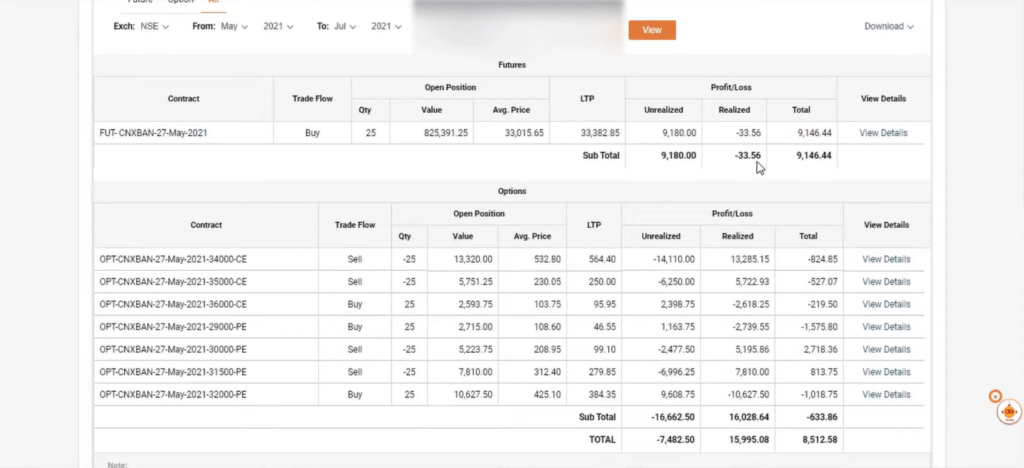

Step 4: Now check your ICICI Direct demat account to check the stocks you have bought or sold and also check if you have any equity portfolio holdings.

Step 5: Now assess the profit and loss area to assess the profitability of your stock holdings. However, be sure that the companies you’re considering as a stop-loss are profitable.

Step 6: Now, within the app, find the option to set up a stop-loss for your investments. This frequently appears in the trading or investing section.

Step 7: Identify the stocks for which you wish to set up a stop-loss and provide the quantity (lot size) for each.

Step 8: Set a stop-loss price to each stock. This is the price at which you want it to automatically sell the stock if it meets a certain threshold.

Step 9: Verify the stop-loss information for accuracy, and check any associated charges or fees.

Step 10: Once you’ve settled on the criteria, send the stop-loss orders for execution.

Step 11: After placing the orders, regularly review your portfolio to track the performance of your holdings and modify stop-loss levels as required.

Step 12: If needed, you can remove or change stop-loss orders through the app’s interface.

Stay yourself up-to-date on changes in the market and news that might impact your financial choices.

Following these steps will allow you to properly set a stop-loss in the ICICI Direct and manage your stock holdings more effectively.