What are the Documents Required for Opening an Account with India Infoline?

To open a Demat account with Indian Infoline, you will need to provide the following documents:

- A proof of identity

- A proof of address

- A proof of income

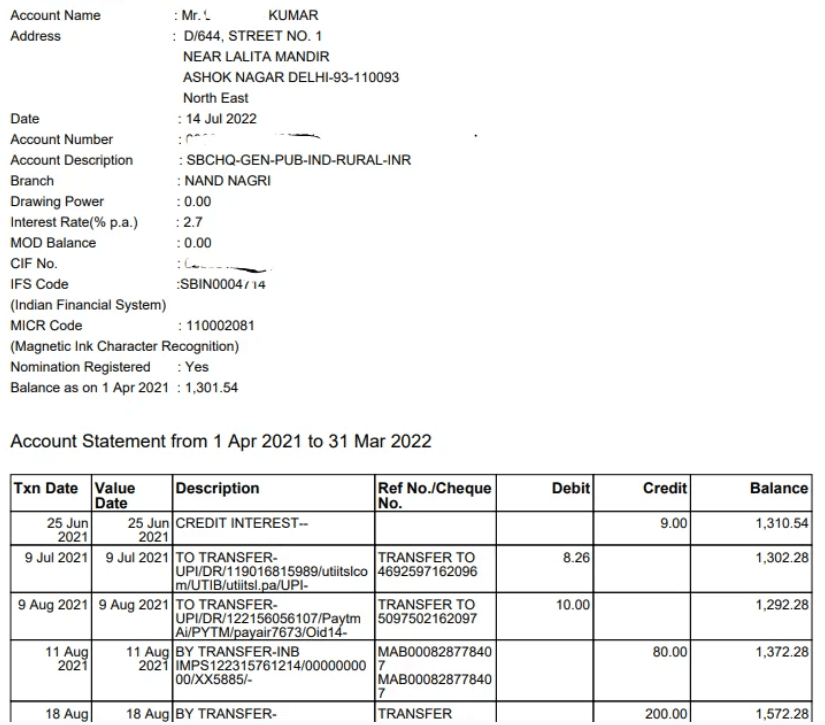

- Bank account proof, such as a cancelled cheque or passbook

- Recent passport-sized photograph

These documents are essential to comply with regulatory requirements and ensure a smooth account opening process. Make sure to have these documents ready when you initiate the account opening procedure with Indian Infoline

Eligibility to Open a Demat Account

Demat accounts can be opened by a diverse range of individuals and entities, including:

- Resident Individuals

- Minors (to be operated by a guardian/parent until the minor turns 18)

- Non-Resident Indians

- Corporate Entities

- Partnership Firms (with the account in the partner’s name)

- Registered/Unregistered Trusts (account in the name of trustees)

- Registered/Unregistered Societies (account in the name of members)

- Associations of Persons (AOP)

- Limited Liability Partnerships (LLP)

- Banks and Mutual Funds (for specific purposes)

- Foreign Institutional Investors and Foreign Portfolio Investors (for trading accounts).

Types of Documents Required

Proof of Identity:

- PAN card with a valid photograph

- Any document with a Unique Identification Number (UID) like Aadhaar, passport, voter ID card, or driving license

- Ration card (with photograph)

- Identity cards issued by authorized bodies like Central or State Government, statutory or regulatory authorities, PSUs, scheduled commercial banks, Public Financial Institutions, and professional bodies (e.g., ICAI, ICSI, ICWAI, or Bar Council).

Proof of Address:

- Passport

- Voter’s card

- Ration card

- Registered lease or sale agreement of current residence

- Driver’s license

- Utility bill (not older than three months from application date)

- Insurance copy

- Bank account statement or passbook (not more than three months old)

- Government or statutory authority document

- Address proof issued by authorized entities.

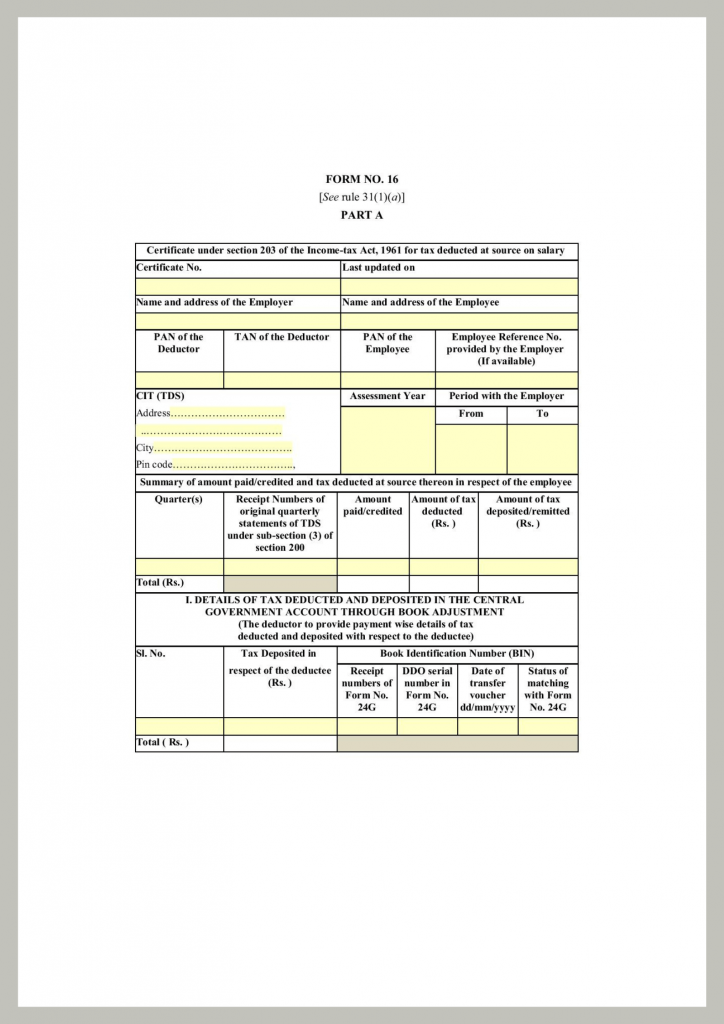

Proof of Income:

- Income Tax Return copy

- Net Worth Certificate certified by a Chartered Accountant

- Salary proof

- Demat account holdings statement with other Depository Participant

- Current bank account statement showing the history of past six months income.

Documents for Opening a Minor Demat Account

Specific documents are required for those looking to open a Demat account for a minor. The minor must be the sole holder of the account, and only a parent or guardian can operate it. The necessary documents include:

- Copy of the minor’s PAN card

- Copy of the minor’s birth certificate

- PAN card of the guardian with a clearly visible photo

- Proof of bank accounts held in the name of the minor

- Proof of address of the guardian.

Attestation of Documents

Certain authorized individuals and entities are eligible to attest to the proof documents. This includes officials of overseas branches of scheduled commercial banks registered in India, managers of public sector Indian banks, notary publics, court magistrates, judges, Indian Embassies or Consulate Generals, among others.

Additional Requirements for Non-Resident Indians

Non-resident Indians (NRIs) seeking to open a Demat account with an India-based DP must choose between non-resident external (NRE) or non-resident ordinary (NRO) accounts. The necessary documents include proof of both Indian and foreign addresses, a Portfolio Investment Scheme (PIS) letter issued by the RBI, copy of the PAN card, and proof of the bank account category (NRE or NRO).