What are the Documents Required for Opening an Account with Kotak Securities?

If you’re considering entering the stock market, the first step is to open a demat account, a digital platform for trading stocks. The process is streamlined and can be completed online. However, it’s crucial to have the necessary documents on hand. In this article, we will outline the specific documents required for opening an account with Kotak Securities.

Documents Needed for Opening a Demat Account with Kotak Securities:

To open a demat account with Kotak Securities, you will need the following four essential documents:

- Duly filled in account opening form

- Passport-size photographs

- PAN card

- Aadhaar card (can be used as both ID and address proof)

Note: Voter ID and driving license are also accepted as valid documents.

Types of Demat Accounts:

Before delving into the required documents, it’s important to understand the various types of demat accounts available:

- Individual Demat Account

- Joint Demat Account

- Corporate Demat Account

- Demat Account for NRIs

Documents Required for Identity Verification:

To open any type of demat account, providing valid identification is mandatory. The following documents are accepted as proof of identity:

- PAN card

- Aadhaar card

- Passport

- Voter ID

- Driving license

- Any other government-issued photo ID card

- Photo credit or debit cards issued by Indian banks

Documents Required for Address Verification:

A valid proof of address is also required. The following documents are accepted for this purpose:

- Passport

- Voter ID

- Driving license

- Sale or lease agreement of current residence

- Current utility bill (landline telephone/electricity/gas)

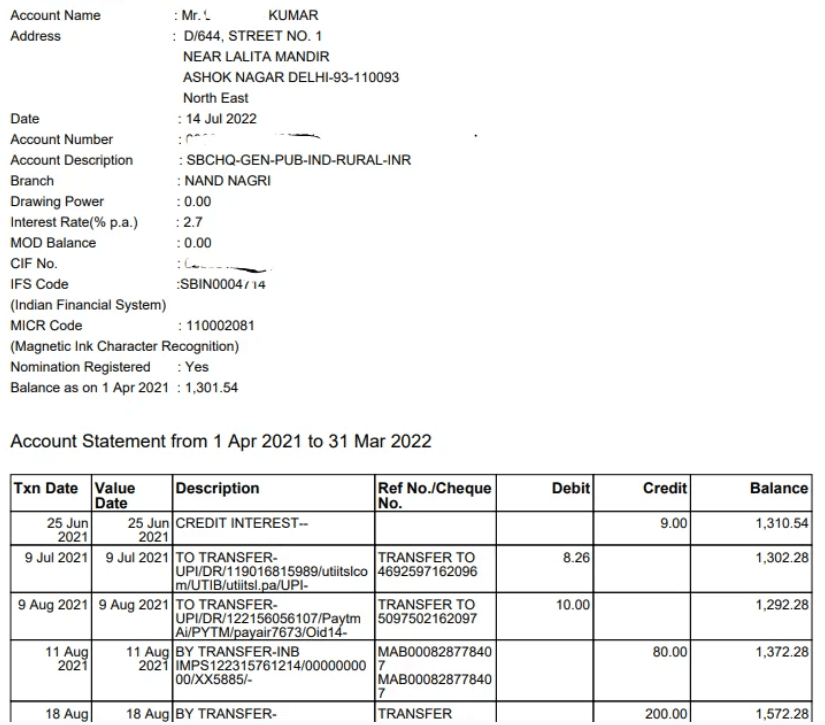

- Bank statements of the last three months

- Proof of address issued by a bank manager

Note: Address proof documents can be in the name of your spouse and will still be accepted.

Documents for Financial Status Verification:

Apart from ID and address proof, you’ll need to prove your financial status. The following documents are required:

- Acknowledgement copy of your Income Tax Return (ITR)

- Salary slips of the last three months or Form 16

- Bank account statements of the last six months

Authorized Personnel for Document Attestation:

Your documents can be attested by the following authorized individuals:

- Notary public

- Gazetted officer

- Bank manager (with name, designation, and seal)

For NRI demat accounts, attestation can be done by:

- Manager of an Indian scheduled bank’s foreign branch

- Notary public

- Judge

- Court magistrate

- Indian Embassy or the Consulate General of the country of residence

Conclusion

Opening a demat account with Kotak Securities is a straightforward process. Begin by determining the type of account you wish to open and ensure you have the required documents readily available. Get any necessary attestations done in advance for a smooth experience. Communicate with your relationship manager for guidance and clarification. With the right preparations, you’ll be ready to start trading and watch your wealth grow.