Eligibility Criteria to Open Demat Account

A Demat account allows you to hold securities in digital form. However, there are certain eligibility criteria to open a Demat account. They are based on different parameters like age limit, residential status, essential documents for identity and address proofs, etc. For instance, an individual must be a citizen of India and 18 years of age. In addition, he should have documents like Aadhar, PAN or Voter ID. It is crucial to understand these requirements properly. This guide discusses all the eligibility criteria to open your Demat account.

Table of Contents

Eligibility Criteria for Opening a Demat Account

Age Limit

In India, the minimum age to open a Demat account is 18 years. However, some institutions may offer provisions for minors to open a Demat account under the guidance of a guardian or parent.

Residential Status

One must be a citizen of India to open a Demat account. The residential status is important as it ensures compliance with the regulations and laws governing securities trading in that jurisdiction. Non-residents have separate terms and conditions to hold a Demat account in India.

Documentation Requirements

Documents serve as proof of identity, address, and other necessary information. You can provide a passport, driver’s license, Aadhaar card (in India), recent utility bills, bank statement, ration card, or rent agreement. Also, provide a Permanent Account Number (PAN).

Passport-size Photographs

Typically, two or three recent passport-size photographs are needed for the application process. It is preferable to always provide a recent colour photograph.

Financial Requirements

While there may not be stringent financial criteria to open a basic Demat account, certain financial institutions or brokerage firms may have minimum deposit requirements. The minimum deposit may vary depending on the institution and your account type.

Selection of a Depository Participant (DP)

To open a Demat account, you need to choose a Depository Participant (DP). A DP acts as an intermediary between you and the depository, which holds your electronic securities. It is crucial to select a reliable DP that is registered with the regulatory authorities and has a good reputation in the market. Different DPs may have varying eligibility criteria and services, so it is advisable to research and compare options before making a decision.

Who can Hold a Demat Account?

Any individual above 18 years of age having the due documents is eligible to open Demat accounts in India. The following individuals and entities can open a Demat account.

- Single Demat account holder: An individual can open a Demat account and add a nominee to it.

- Joint Demat account holder: As per SEBI regulations, a Demat account may have up to three account holders. One individual is the primary holder and the two others will be joint holders.

- Minor Demat account holder: Minors can also hold a Demat account. However, until the age of 18, his parents or a legal guardian shall manage it. After that, the minor can complete the due formalities with the DP and obtain the authority to operate

- Demat account for Trust: Private or unregistered trusts may also open a Demat account.

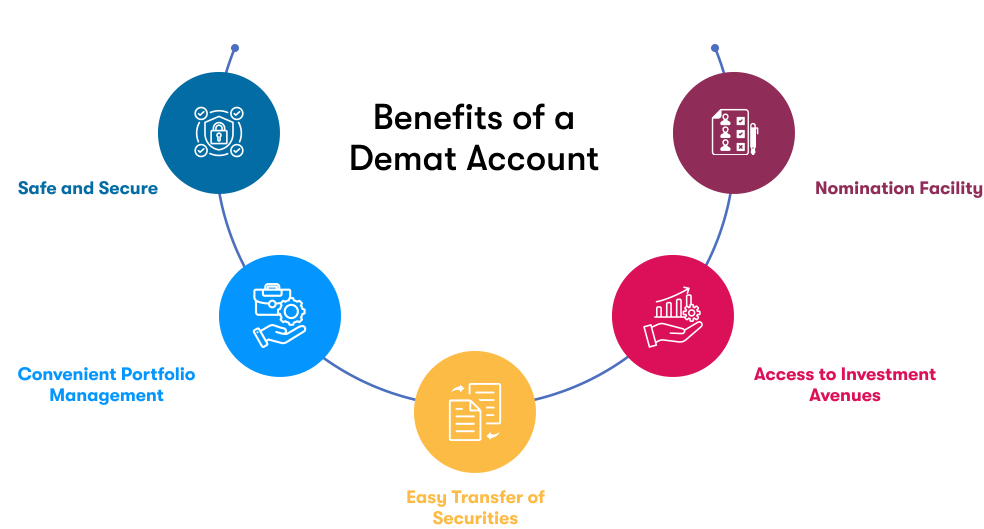

Benefits of a Demat Account

Here are the key benefits of a Demat account.

Safe and Secure

Demat accounts provide enhanced safety and security for holding securities. It eliminates the risks associated with physical certificates, such as loss, theft, damage, or forgery.

Convenient Portfolio Management

With a Demat account, investors can conveniently manage their investment portfolio. They can track their holdings, view transaction history, and monitor the market in real-time.

Easy Transfer of Securities

Demat accounts facilitate a seamless transfer of securities. Instead of lengthy and cumbersome paperwork, electronic transfers are quick and efficient. This simplifies the process of buying, selling, and transferring securities.

Access to Investment Avenues

Demat accounts open up a wide range of investment opportunities. Investors can trade equities, mutual funds, bonds, and other financial instruments with just one account.

Nomination Facility

Demat accounts offer a nomination facility. This allows account holders to nominate individuals who will inherit their securities in the event of their demise.

Conclusion

Opening a Demat account gives investors a digital platform to hold and trade securities securely. To meet eligibility requirements to open a demat account, individuals typically need to be of the minimum age required by the regulatory authorities, hold the necessary identification and address proof documents, and comply with any financial requirements set by the institution. By fulfilling these eligibility criteria and choosing a reputable DP, investors can gain access to the benefits of electronic securities holding and trading, thereby participating effectively in the financial markets.